VTSAX = Vanguard Total Stock Market Index Fund Admiral Shares

VTI = Vanguard Total Stock Market ETF

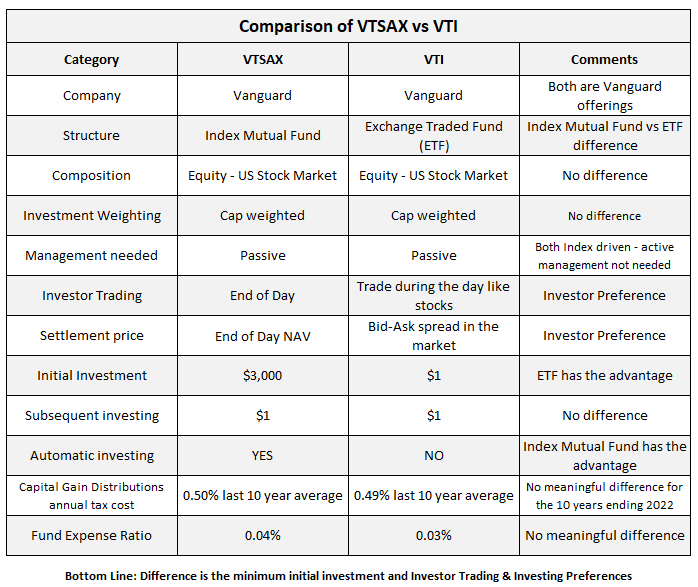

Both VTSAX and VTI are Vanguard products, and they both allow the investor to invest in the entire US Stock Market.

Their composition is aimed to be of identical investments. They are cap weighted funds, which means that the investment makeup of the individual stocks held within each one is weighted based on the market value of each company compared to the total US Stock Market. Because of this, the larger companies in the US Stock Market have a larger percentage of the fund makeup. This is why both VTSAX and VTI often perform relatively similar to an S&P 500 Fund (500 largest US companies).

Low Expense Ratios

Vanguard is well known for low costs on its investments. Both VTSAX and VTI are no different. The current expense ratio for VTSAX is 0.04% and VTI is 0.03%. The difference is 0.01%, or one basis point. This difference is so small it is almost not even worth mentioning. Before investing, be sure to check the latest expense ratios (Vanguard links at the beginning of this article), as they can change over time.

Fees make a big difference in investment returns over time, as described in this Investopedia Article. In this case, however, the fees are so minuscule that the fees will not be an issue with either investment choice.

One of the reasons for the lower expense ratio is that these are both passive index investments as opposed to an actively managed investment. A passive investment that follows an index (in this case a US market cap weighted one), does not require the costs associated with active investment management. In other words, you don’t need investment managers to make decisions of what investments to buy and sell as the index determines that automatically. The fees are also kept low by Vanguard’s corporate structure, where the investors are the shareholders, which in theory keeps all costs lower as company profits are used to offset fees.

Key Differences

The main difference between these two investment choices is in the investment structure. VTSAX in a Index Fund, and VTI is an ETF, or Exchange Traded Fund. As a result, the choice between VTSAX and VTI will be based largely on personal preference of investing via an Index fund or an ETF.

Index Funds vs Exchange Traded Funds (ETFs)

The main difference is that ETFs (Exchange Traded Mutual Funds) trade throughout the day (just like stocks) and Index funds (which are structured like traditional mutual funds), only trade at the closing market price at the end of the trading day. If you are a long term investor (not doing intra-day trading), this likely won’t make a big difference to you either way.

Minimum investment requirement

For investors just getting started, ETFs often have a much lower investment entry point than a Mutual Fund. This holds true here as well. The minimum initial investment for VTSAX is $3,000. The ETF minimum would be the cost of one share (like a stock), and often even lower than that as many brokers allow for the purchase of fractional shares (less than one share increments). As of the writing of this article, VTI is trading at about $225 for one share, so you can see the ETF investment entry point is much lower. With fractional shares, you could invest in VTI for just one dollar.

Note that for VTSAX, $3,000 is the amount needed to invest initially. Subsequent investments in the fund (once $3,000 is invested) do not have a minimum requirement.

Automatic Investments

Index Funds have the benefit of allowing you to automatically invest. This is because the fund only exchanges shares at the end of the business day. Since this is the case, you can automatically invest a set dollar amount into the fund on a regular interval, just as you would do with a 401(K) with your employer. When Vanguard, in this case, receives your automatic investment, the money will go into the fund at the next available end of day price. Since ETFs trade just like stocks throughout the day, you have to enter a trade to buy the security with either a market order or limit order, which requires manual (non-automated) effort.

Tax Efficiency

ETFs typically have the edge on Index Funds when it comes to tax efficiency. This would only be an issue in a taxable brokerage account. This is due to the structural difference in the traditional mutual fund rules vs the ETF rules.

When stocks are bought and sold within the index fund by the passive managers, this often results in net capital gains. Traditional mutual fund rules require that the those net capital gains get passed through to all of the fund investors in the form of capital gain distributions. Short term net capital gains will show up in Box 1a of form 1099-DIV as “Ordinary Dividends” and net long term capital gains will show up on form 1099-DIV in box 2a as “Capital Gain Distributions.” Both of these amounts will need to get picked up on your tax return as additional taxable income.

ETFs also have share transactions similar to index funds, but because they are able to do “in kind” transactions with other major financial institutions to help perform this internal balancing, they are able to avoid many of the capital gains, which is a win for investors. You can read more about this at the Vanguard website.

What does all this mean? Interestingly, Vanguard has a unique way that it has structured it’s internal rebalancing process to keep net capital gain distributions as low as possible, for both traditional mutual funds, like VTSAX, and Exchange Traded mutual funds, such as VTI.

Let’s take a closer look at the numbers to see what difference there is between the two choices regarding the impact of taxable capital gain distributions.

Tax Efficiency: a review of the numbers for VTI and VTSAX

The numbers for VTI

Source: Vanguard Summary Prospectus

The additional annual cost in a taxable account for VTI required distributions to investors (shown above) would be the difference in the return between the “Return After taxes on Distributions” and the “Return Before Taxes.”

- One year as of 12/31/2022 = (-19.82% – (-19.50%)) = 0.32% of additional cost

- Five years as of 12/31/2022 = (8.27% – 8.72%) = 0.45% of additional cost

- Ten years as of 12/31/2022 = (11.59% – 12.08%) = 0.49% of additional cost

The Numbers for VTSAX

Source: Vanguard Summary Prospectus

The additional annual cost in taxable account for VTSAX required distributions to investors (shown above) would be the difference in the return between the “Return After taxes on Distributions” and the “Return Before Taxes.”

- One year as of 12/31/2022 = (-19.84% – (-19.53%)) = 0.31% of additional cost

- Five years as of 12/31/2022 = (8.26% – 8.71%) = 0.45% of additional cost

- Ten years as of 12/31/2022 = (11.58% – 12.08%) = 0.50% of additional cost

Comparing tax efficiency

So, when you compare these two investment choices, there is really a negligible difference as far as the tax efficiency impact. Typically the gap would be much greater in favor of the ETF vs the Traditional Fund, but not in this case for these Vanguard Funds.

As you can see, VTI is 0.01% worse (cost of 0.32% vs 0.31%) than VTSAX for the one year period, they are both identical for the 5 year period (cost of 0.45% per year for both), and VTI is 0.01% better (0.49% cost vs 0.50% cost) for the 10 year period. In other words, as things stand today, you are not getting any kind of material tax benefit in one choice vs the other.

Note that these distributions only have an impact on taxable brokerage accounts. For retirement accounts, you won’t receive a 1099-DIV for these distributions as the funds stay in the investment and don’t leave your retirement account.

This is a good exercise to do when comparing other Fund vs ETF choices for the same index for a taxable account. The differences could be a lot greater which would help you decide which choice is less expensive.

You can read more about this at the IRS website explaining why an investor might receive a 1099-DIV for capital gain distributions even though they didn’t sell any investments during the year.

For more information on ETFs vs Index Funds, see this Investopedia article.

ETF transaction costs

One additional cost related to an ETF that you don’t have with a traditional mutual fund would be transaction costs. These transaction costs would be any broker commissions on the sale and also the additional cost of the transaction price due to the bid / ask spread in the market.

Nowadays, you shouldn’t be paying a broker commission to buy and sell stocks or ETFs, as most allow you to trade for free. So, that brings us to the bid / ask spread. This is the slight amount of overpaying you might do in order to close your transaction. It’s hard to quantify this. You can reduce this risk if you use limit orders, which means you only get the price (or better) that you are willing to pay. With a market order, you are subject to whatever you get for the transaction.

Mutual funds don’t have this bid / ask issue on a live market transaction basis for the investor, as shares are exchanged at the NAV (Net Asset Value) per share of the fund at the end of the business day.

Bottom Line

Both VTSAX and VTI are solid, low cost investments for investors that want to own the entire US Stock Market as part of their investment portfolio. The main differences between the two primarily has to do with the structural differences between a Traditional Mutual Fund and an Exchange Traded Fund (ETF). These differences are noted above and in the executive summary below.

The choice in this case comes down to personal preference on investment minimums and how you like to invest and trade.

Executive Summary – Vanguard VTSAX vs VTI: How to Choose Between Them

- Both VTSAX and VTI are mutual funds managed by Vanguard

- VTSAX is a traditional mutual fund and VTI is an Exchange Traded Mutual Fund

- The composition of both investments is to mimic the total US Stock Market based on company market size (cap weighting)

- This means the fund composition is tilted toward large-cap companies, with the top holdings being the largest cap companies in the market

- These funds are considered passively managed, as they are providing the index to investors (no active management decisions needed)

- Both of these investment funds are low cost

- Lower fees are due to Vanguard’s unique investors = shareholders structure as well as these funds being passively vs actively managed

- The biggest difference is in owning a Traditional Mutual Fund (VTSAX) vs an ETF (VTI)

- VTI allows you to buy and sell during the business day (just like stocks) where VTSAX only allows you to buy or sell at the next available end of business day fund value

- VTI has a low initial investment of just $1 (with fractional shares) whereas VTSAX requires new investors to invest $3,000 initially

- You can invest automatically with VTSAX whereas VTI will require you to place manual trades for additional investments

- ETFs are normally more tax efficient, but in this case the difference between VTSAX and VTI is not a decision maker

- VTI has the risk of the share bid-ask spread transaction costs during the trading day whereas VTSAX transactions use the share price at the end of the day

- Bottom line is the choice difference between the two comes down to personal preference of the Traditional Mutual Fund (VTSAX) vs ETF (VTI) noted above

Disclaimer

Disclaimer: Investing has the risk of loss. Be sure to understand all the risks before investing. Read the prospectus. Validate data from multiple sources before making any investment decisions. If you decide to use a financial planner, be sure to use a Fee-Only Financial Advisor that is a Fiduciary, which legally obligates them to do what is in your best interest and not theirs!

Other Articles to Read:

- Do I pay Taxes on Stocks, even if I don’t sell them?

- Use the Longevity Illustrator to Plan your Retirement

- Questions to Ask your Financial Advisor each year

- Best small cap ETFs to compliment your equity portfolio

- Fund Comparison: Vanguard VTSAX vs Fidelity FSKAX

- Total Stock Market Fund VTSAX vs S&P500 ETF VOO