Net Worth

It’s hard to set goals or know if you are improving if you don’t know where you are to start with. Take some time now to estimate your net worth. When we talk about wealth, we are talking about net worth. The larger your net worth, the larger your wealth. You don’t need exact numbers, just reasonable values (some are not exact, like car or home values). Your goal should be to get a good estimate so you have something to compare to later this year or next year to see if you are improving.

It’s hard to set goals or know if you are improving if you don’t know where you are to start with. Take some time now to estimate your net worth. When we talk about wealth, we are talking about net worth. The larger your net worth, the larger your wealth. You don’t need exact numbers, just reasonable values (some are not exact, like car or home values). Your goal should be to get a good estimate so you have something to compare to later this year or next year to see if you are improving.

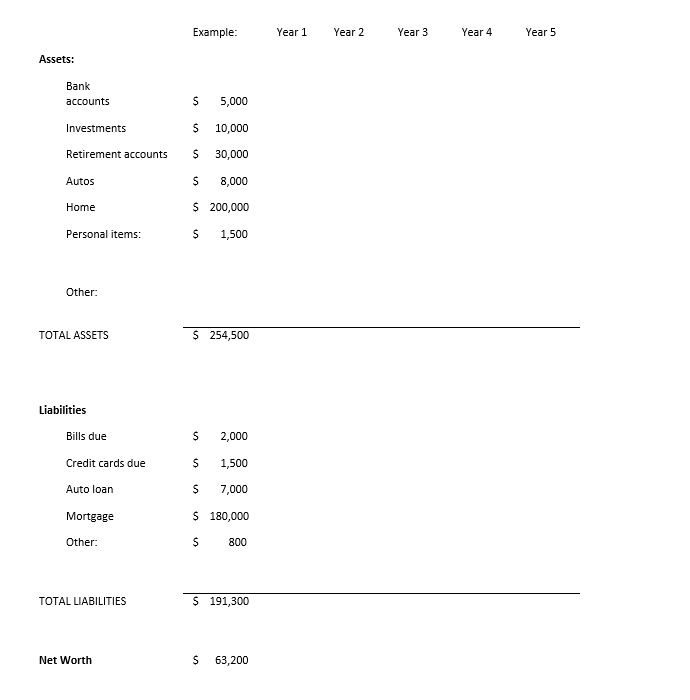

Net worth would be your assets minus your liabilities. Assets would be things like bank accounts, investments, cars, homes, and significant personal items. Make a list of these assets along with your best estimates of what those items are worth today (what a willing buyer likely pay for it). Liabilities would be things like car loans, mortgage loans, student loans, credit card debts and unpaid bills. Make a list of these liabilities along with the amounts due. If your assets exceed your liabilities you have equity or a positive net worth. If your liabilities exceed your assets you have negative equity or a negative net worth. Regardless, you need to know where you are at so you have a baseline. You’ll then be able to compare this baseline to future results to see if you are improving your financial position or not.

How do you improve your net worth? Save more (increase your income or decrease your spending) and use this excess to pay down your liabilities or increase your assets or a combination of both!

Click here to download my net worth calculator template!