Making retirement plan contributions is one of the most important financial decisions you will make during your working years.

It’s important to understand the key differences so you can make an informed decision.

The good thing is that your retirement plan decisions can be made again every year, so you will be able to make changes and adjustments along the way.

Let’s get started.

Why does the government offer Roth and Traditional plans?

It’s in everyone’s best interest (especially your own) that workers save for their retirement. With pensions no longer available for most new retirees, too many will rely primarily on Social Security benefits. Social Security by itself won’t be enough for a secure retirement. As a result, the government would like to provide an incentive for employees to save additional amounts using plans designed for retirement savings.

One incentive [Traditional Plan] lets people put money in a retirement plan on a pretax basis with no tax due until decades later when withdrawing the money in retirement. This concept is a basic tenant of tax planning, which is to generally defer taxes whenever possible.

Another incentive [Roth Plan] lets people put money in a retirement plan after tax (tax already paid), but then allows you to withdraw that money and its earnings in retirement tax free. This is more expensive initially as you pay the taxes up front. However, every dollar is worth more than a dollar in a traditional pretax plan as it will be tax free upon withdrawal.

In order to get the benefits of these accounts, you need to follow the rules as you have declared these funds as being for retirement once you set them up. The role of the Internal Revenue Service (IRS) is to make sure you are following the rules.

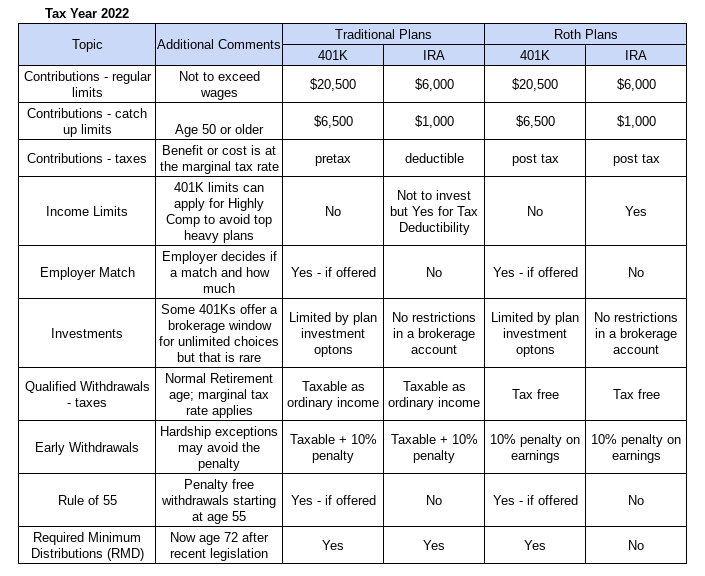

Quick Reference Table

Roth account vs Traditional account

Generally speaking, the accounts can be described again as:

Traditional = Retirement pre-tax account type that allows you to contribute your earnings before you pay income taxes, but then income taxes are due when you withdraw later

Roth = Retirement after-tax account type that allows you to contribute your earnings after you pay income taxes, but then later withdraw that money tax free

Of course I am oversimplifying but these are by far the biggest differences.

Roth Deferrals

The Roth is a retirement account based on a bill proposed by senator William Roth that became law in the late 1990’s. Roth individual retirement accounts (IRAs) came first in 1997. Roth 401(K)s followed later in 2001.

By employee deferrals it typically means that you are deferring part of your gross paycheck into a Roth 401(K), with the plan of getting a benefit at a later time by making tax free qualified withdrawals.

You can defer your money into a Roth 401(K) or a Roth IRA. In both cases you are putting money away now with after-tax dollars. There are some significant differences between the two types of Roth accounts. Let’s discuss them next.

Roth Contribution Limits

Contribution limits are quite a bit different between Roth 401Ks versus Roth IRAs. Note that in order to be able to invest in aRoth 401K, you must have access to an employer-sponsored plan that allows Roth 401Ks. Some plans do not.

As of the writing of this article (2022), the maximum Roth IRA contribution is $6,000 for the year ($1,000 more if 50 or older). Note that there are restrictions on being able to invest that amount or less during the year. First, you can’t exceed the single or married contribution limits based on your income. In other words, if you earn too much you can’t invest in a Roth IRA that year. Second, you can only invest up to your income. For example if you only earned $3,000 in a year working part time you can only put $3,000 in a Roth IRA.

The Roth 401K lets you invest quite a bit more. There are no income limits to invest in a Roth 401K unless you are an HCE (Highly Compensated Employee) and your employer has to limit your contributions to prevent a retirement plan violation. Second, you can invest up to $20,500 per year in your Roth 401(K) in 2022, which is a lot more than a Roth IRA. If you are 50 years of age or older at any time during the calendar year, you are also allowed to invest up to an additional $6,500 in catch-up 401K contributions.

So again, the basic Roth contribution limits in 2022 are:

- Roth IRA: $6,000 per person ($1,000 more if 50 or older) not to exceed earned income

- Roth 401(K): $20,500 + $6,500 in catch-up contributions (if age 50 or older)

Investment Options

The IRAs have the advantage when it comes to investing. That is because you can open a brokerage account just about anywhere and set up an individual retirement account. Once set up you will have full rein to invest in mutual funds, ETFs, individual stocks, etc.

401Ks are a little different in that you can only invest in the limited investment options offered by the plan. This can be quite limiting if the investments you want are not available.

Required minimum distribution (RMD)

One benefit of the Roth option is that there are no required minimum distributions in retirement as you have with a traditional IRA or 401K. What that means is that you won’t be forced to take money out late in retirement if you don’t want to.

Not the case for a traditional IRA. Once you reach the required age of 72, you must take out an RMD. I know people complain about it, but remember than an IRA is designed for your retirement, not to give money to heirs. The IRS wants their taxes on a traditional plan ideally during your lifetime. If you don’t start taking out some of your IRA starting in your 70’s, when will you?

Tax advantages

The money you put into your Roth is after tax, because you have already paid income tax on it. For a traditional plan, you get to contribute the money on a pretax basis.

However, when you make a qualified distribution of money in retirement it is considered ordinary income, which is generally higher than capital gains rates, and of course higher than a Roth which is tax free.

Disclaimer: This article was written in 2022. The rules keep changing over time so be sure to validate with other sources to confirm the accuracy.

Early Withdrawal Penalties

The Roth IRA is more forgiving when it comes to early withdrawals. Generally speaking, you can withdraw your Roth contributions anytime after 5 years penalty and tax free. The earnings can’t be withdrawn until age 59 1/2 in order to avoid a 10% early withdrawal penalty.

A traditional plan, since it’s pretax, does not have favorable early withdrawal treatment. You will pay income tax and a 10% penalty for an early withdrawal (before age 59 1/2) unless you meet a hardship withdrawal exception, use a periodic withdrawal option (72T), or qualify for the rule of 55 (401K plans only).

401K vs IRA

As mentioned earlier, you can contribute a lot more to a 401K plan than you can with an IRA.

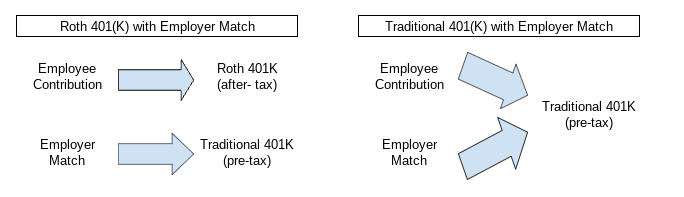

With a 401K you may also likely get an employer match, which means you will get even more money invested. The interesting thing about the match to a Roth 401K, is that the match goes into a traditional plan whereas your contribution goes into a Roth. In other words, your Roth contribution goes in with post-tax dollars and the company match goes in outside of the Roth as pre-tax dollars.

The graphic below shows you how this works:

Roth or Traditional – which is better

There is no easy answer on this one. It depends on what tax rates are now vs what they will be in the future. Since we don’t know the future any decision will be uncertain.

If you are in a low income tax bracket right now, it makes sense to take a smaller tax hit to get the tax issue behind you and grow a tax free nest egg for the future.

If you are in a high tax bracket, you’ll need to run some math using tax rate assumptions in the future to determine which option might be better. Sometimes people are so in love with the Roth and the concept of tax free withdrawals that they don’t do that. Consider instead if you take the tax savings of a traditional contribution and invest that tax savings money too, which could grow quite a bit over the years.

Here is a link to a Traditional vs Roth 401K analyzer you can use to run some scenarios.

It also makes sense to have both Roth and Traditional accounts when entering retirement, as that gives you the best flexibility to orchestrate the exact amount of taxable and non-tax withdrawals to keep you in the lowest possible marginal tax bracket.

Summary: Roth contributions vs Traditional retirement deferrals

- Traditional accounts have pre-tax contributions but taxable withdrawals

- Roth accounts have after tax employee contributions but tax-free withdrawals

- The government offers both of these plans to incentivize people to save for retirement, as pensions are disappearing and social security often won’t be enough

- You can contribute a lot more per year in a 401K ($20,500 + $6,500 catch up 50 or older) vs an IRA ($6,000 + $1,000 catch up for 50 or older)

- An IRA is superior to a 401K for investment choices because a 401K limits you to what the plan sponsor has selected as investment options

- A traditional plan has a Required Minimum distribution starting at age 72; A Roth IRA does not have an RMD

- A Roth IRA has more flexible early withdrawal options

- A 401K plan often gives you a company match (free money); an IRA can’t compete with that

Disclaimer: Mistakes can be made. This information is not guaranteed to be 100% accurate. Always verify data from multiple sources before taking action. If you use an advisor, make sure they are a fiduciary acting in your best interest and not theirs!