It’s well know in the personal investment community that a 4% Safe Withdrawal Rate (herein called “SWR”) is the general standard for planning for retirement. It is based on a fantastic study by William Bengen in 1994 that proved that based on a classic equity / bond portfolio that a 4% SWR would allow you to not run out of money for a 30 year period, which is generally long enough for most retirements.

The 4% rule is so widely known that it appears to me that almost everyone treats it as gospel these days without questioning it. In planning my own retirement and looking for ways to improve the probability of success, I decided to dig deeper for better results.

Is There Something Better?

One drawback of the 4% rule is that is only looks at two asset classes, stocks and bonds. That is very limiting. There are more asset choices available to create other portfolio mix options that can reduce volatility and increase the Safe withdrawal Rate.

This led me to read a number of books as well as internet research. What I found was astounding and unexpected! It was also not intuitive. When I share this with you I’ll bet you agree.

One of the breaking moments was reviewing the portfolios and corresponding with Tyler, owner of Portfoliocharts.com. He dedicated his site to studying a number of different portfolios and outcomes. His site even has a “My Portfolio” section where you can try different portfolios that you can test using the last 50 years of history (1970 – 2019). His site is truly outstanding!

The Permanent Portfolio

In doing his work Tyler studied lots of portfolios. He was looking for a better risk adjusted return than the Classic equity and bond mixes we are all familiar with. One Portfolio he studied was the “Permanent Portfolio” which is from a book written by Craig Rowland and J.M. Lawson. It is based on a portfolio first proposed by Harry Browne in the 1970’s. That portfolio has a 5.3% safe withdrawal rate and an Ulcer index of just 2.4 (low downside volatility). It uses four equally weighted asset classes (stocks, US Treasury Long Term Bonds, Gold & Cash Equivalents). Wait…long term bonds and gold? Those are investments many investors steer clear from.

What’s amazing about the permanent portfolio is that is takes asset classes, that by themselves, can be quite volatile. Individually you might not even like some of them (like long term bonds and gold). However, when you put them together in a package, they provide amazingly consistent returns with very low volatility. You can see why this would be quite attractive for many in the draw down phase.

When you look at it, Long Term Bonds and Gold are really more of a hedge against deflation or inflation, as well as economic chaos. You wouldn’t typically choose these individually. However, if you view them as the guard rails to prevent a disaster when the stock market is going haywire, you begin to understand the beauty of it.

The Permanent Portfolio is a little too conservative for my taste, but may be applicable for many. I prefer a better return by accepting slightly more volatility.

Beating the “Permanent Portfolio”

Tyler wanted to improve upon this doing his own research. He arrived at a portfolio he calls the “Golden Butterfly” using two approaches . One was adding another asset (5th one) to add to the four asset Permanent portfolio. The other was running 80,000+ portfolio asset combinations in search of the best risk adjusted return.

A 6%+ Safe Withdrawal Rate!

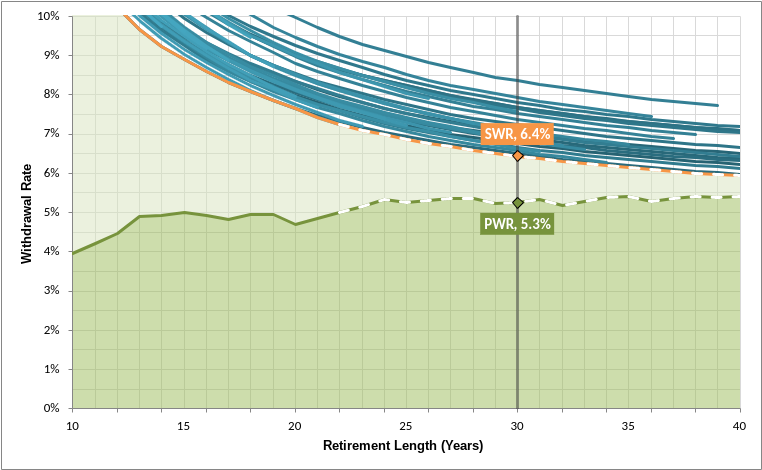

The Golden Butterfly has an astounding 6.4% Safe Withdrawal Rate! Let me repeat that, a 6.4% SWR! Wow! Are you kidding me?

The Golden Butterfly has the following asset allocation, along with some ETFs that line up with these categories.

- 20% Total Stock Market (ie: VTI, FZROX, SCHB)

- 20% Small Cap Value (ie: VBR, FISVX)

- 20% Long Term Bonds (ie: VGLT, FNBGX)

- 20% Short Term Bonds (ie: VGSH, FUMBX, SCHO)

- 20% Gold (ie: GLD, IAU)

Basically this portfolio takes the Permanent Portfolio concept and improves its results by adding another equity component. You can buy any of these with ETFs or Index Funds (see bullet points above for examples).

Let’s digest the impact of the higher SWR for a moment. In order to achieve the typical 4% SWR you have to save 25 times your expected annual expenses.

What if you had a 6.4% SWR? Let’s be conservative and run it at 5.5%. At 5.5% you only need about 18 times your actual expenses. That reduces the amount you need for retirement by 28%.

A Doubled Sided Bonus!

But wait, there’s more. A higher SWR saves you two ways. First, it cuts down the time to get to the number you need for retirement because you need less money (since the safe withdrawal rate is better). Second, the SWR is higher primarily because the portfolio is much more stable and less volatile than the standard equity / bond portfolio. That means you’ll be much more comfortable in your retirement because the roller coaster ride won’t be anywhere near as wild as it would be in a traditional stock / bond portfolio.

I can only imagine how stressful it would be in retirement to see your balance decreasing every year if you drew the unfavorable short stick due to a bad sequence of return risk that put your portfolio on the decline. The SWR means you won’t run out of money, but it doesn’t mean your portfolio won’t be declining. For the Golden Butterfly, if you select a 5.5% withdrawal rate, it looks very promising that your balance likely won’t decrease much if at all.

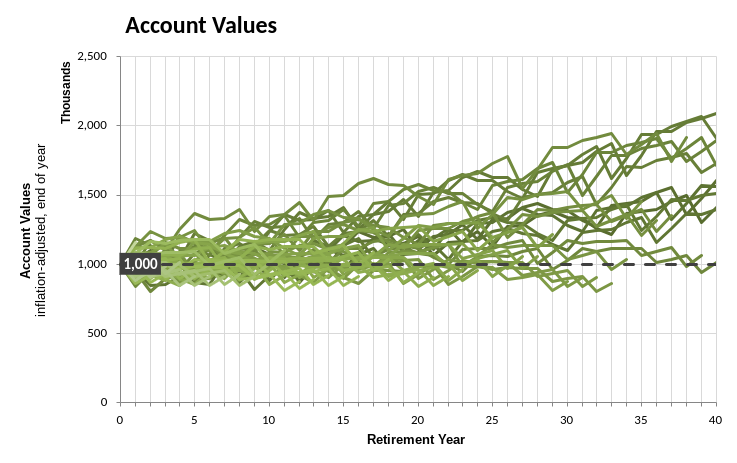

Golden Butterfly – balances using a 5.5% SWR with varying returns using the last 50 years of history (1970-2019)

As you can see from the above chart the results are quite good. Even in some scenarios where the balance did decline over 30 years of withdrawals, it was quite minimal. Using this chart the odds are that in 30 or 40 years you’ll have more money than you started, even after all of your annual withdrawals.

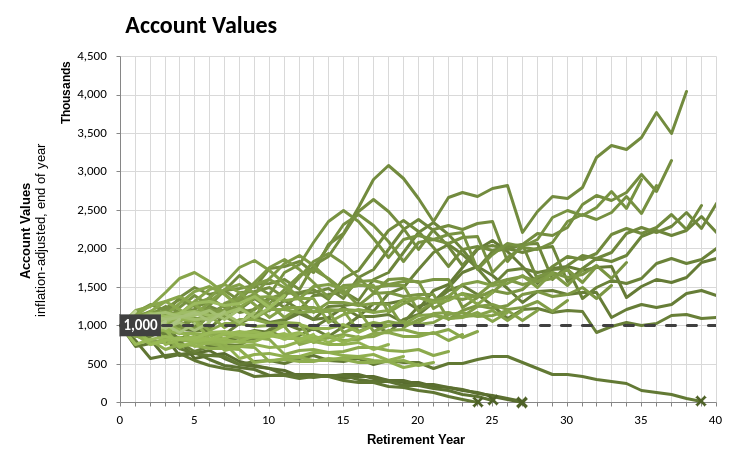

Not the case for the classic 60/40 Equity/Bond portfolio. At a 5.5% SWR you’d be taking some pretty big risks. In the chart below there are a number of scenarios where you would run out of money or be down significantly from your starting balance.

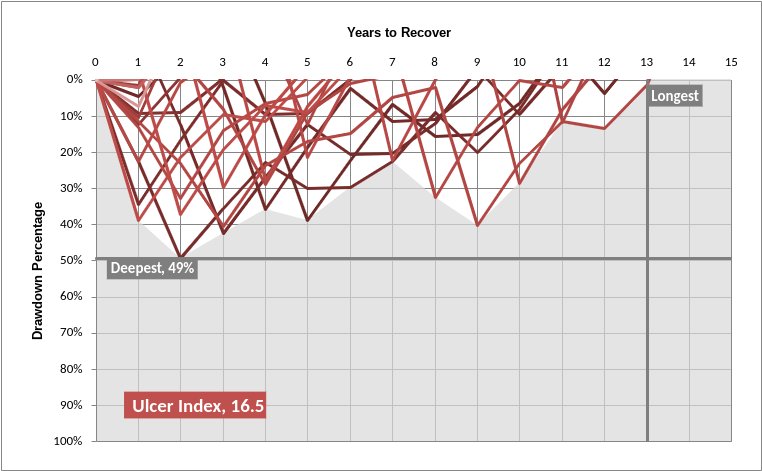

Let’s take an all equity portfolio. The 100% equity portfolio has a high Ulcer Index. The deepest drawdown was almost 50% and the longest recovery was about 13 years. That’s a long time! This high volatility is not for everyone. It’s like riding a very wild roller coaster. When you are talking real money, many people don’t have the stomach for seeing their portfolio drop by 50%. That’s why it might be fine for the accumulation phase but not the withdrawal phase.

The 30 year Safe Withdrawal rate on the 100% equity portfolio per the Portfoliocharts.com site is 4.3% (aka the 4% rule). It doesn’t change much either if you use a 60/40 (4.5% SWR) or even a 40/60 (4.4% SWR) Equity/Bond portfolio.

Withdrawal Phase

Planning for the Withdrawal phase often begins 5 – 10 years before retirement / financial independence and then after, as you can ill afford to have a bad sequence of return risk. Your portfolio has to be set up to have lower volatility. Lower volatility will allow for a higher safe withdrawal rate.

That’s when portfolios such as the Golden Butterfly come into play. They allow you to set a higher SWR so that you can have a better retirement with less volatility and stress!

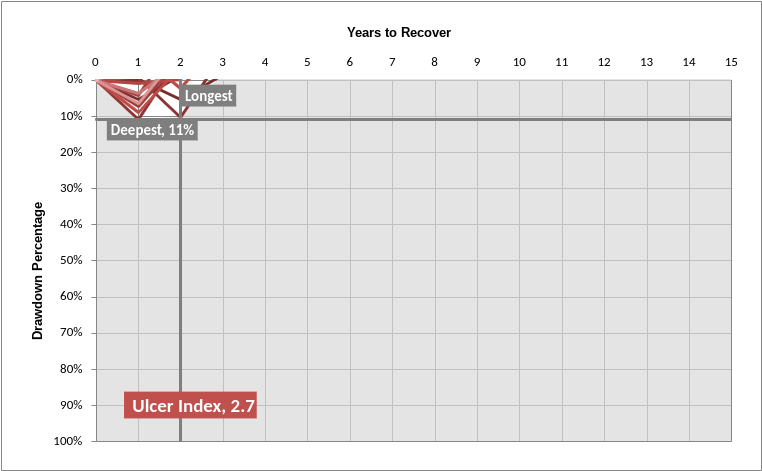

Golden Butterfly – 30 year Safe Withdrawal rate of 6.4%

The Golden Butterfly has a low Ulcer index. Note that the deepest loss was 11% with less than 3 years recovery at the longest.

So let’s take a closer look on what it would mean to use the Golden Butterfly and achieve a 5.5% SWR (to be conservative) instead of the typical 4% SWR with a traditional two asset class equity / bond portfolio. In theory if you needed $80,000 of gross income to retire or become financially independent you would need $2 million invested with a traditional stock / bond portfolio ($2 million x 4% = $80,000). However, with the Golden Butterfly you would only need $1.455 million ($1.455 million x 5.5% = $80,000). That’s about $500,000 less to achieve the same level of income. That could cut years off of your retirement savings plan!

The other way to look at is to go with your same retirement savings goal using the 4% rule but maintain a much higher probability of success due to the “built in cushion” by choosing a less volatile portfolio which a higher expected SWR.

I’ve tinkered with these some more and have been able to approach an even better SWR by adding REITs and backing off on Long term Bonds a bit, while adding Intermediate and Short Term Bonds. I think real estate (direct ownership or REITs) is another important component to a balanced investment plan. By holding some US long term bonds, gold and real estate you can improve diversification and reduce volatility over the standard stock & bond portfolios.

Regardless of the portfolio you choose, annual rebalancing is an important process to ensure you are keeping your investment mix on track. Rebalancing also creates a built in “buy low – sell high” process which is critical to investing success.

As you know investments have a risk of loss and past history is no guarantee of future performance. The goal of this article is to present alternative diversified portfolios to consider that may improve your SWR. Be sure to validate with other sources including your financial advisor before making any investing decisions. Make sure that your financial advisor is a fiduciary acting in your best interest, not theirs!

Summary:

- The 4% rule was a great breakthrough that gave investors a good guide to reduce the risk of running out of money in retirement

- You can improve on the 4% rule by choosing other portfolios that reduce volatility, especially downside risk

- Improving your SWR is a great thing as it allows you to retire with less money while achieving the same level of income; or retire with the same amount of money with a larger “built in cushion” for even more security

- Do more research and investigation to get comfortable with a portfolio that works for you, including discussing with your financial advisor. Make sure your financial advisor is a Fiduciary, acting in your best interest not theirs!

- Don’t just settle for 4% because that is what we are told is gospel

Note that is article focuses on the withdrawal phase of retirement. The accumulation phase is different. If you are decades from retirement you can take more risks with a heavier stock portfolio. Equities will likely get you to the destination quicker, but the roller coaster ride will be quite rough. Once you are 10 years from retirement you need to consider a different mix as a significant downside event could set you back a decade or more toward your retirement plan.

As always I welcome all comments and points of view.