Charles Schwab is one of the top major investment companies offering a wide array of low cost ETFs and index funds for the average investor.

Their two major competitors, Vanguard and Fidelity, also offer low cost index funds and ETFs.

All of this competition has resulted in some of the lowest fees around, including free trades. This is great news for the DIY investor!

Why Index Funds and Index ETFs

Index Funds and ETFs have a number of built in advantages. First, they provide great diversification within an asset class. So, instead of owning individual stocks which carry a high investment risk, consider an index fund that would hold hundreds, or even thousands of stocks in that index. Having a variety of fund choices in many asset classes also puts you in a good position to build a diversified portfolio.

Second, it’s been proven time and time again that the vast majority of active fund managers cannot beat the market over time. This is partly because you can’t predict the future but also because the higher fees embedded in actively managed funds eat up your returns over time.

Finally, index funds and ETF’s are often quite a bit more tax efficient than actively managed funds, so you end up doing better with fees and often with taxes too. How cool is that?

Here is a link to Schwab’s website that explains these benefits and much more!

Also see this investopedia article regarding active management vs passive investment performance

Fees really make a difference over time

It’s been proven over and over that investments with a low expense ratio will perform dramatically better than a similar investment with much higher fees. A half of a percent (50 basis points) to one percent (100 basis points) might not seem like a lot, but over time it makes a massive difference!

There is no doubt that due to the heavy competition of fund companies that some offer such low fees (even zero percent) that they act as loss leaders for the firm. In other words, they will lose money on a few very low cost index funds to get you in their ecosystem, with the plan to profit from you over time with other investment products and services.

See this Investopedia article regarding the impact of fees on returns.

Schwab Index Funds and Index ETFs

I won’t spend the time here to explain the pros and cons of Index Funds vs ETFs. If you want to dive into this topic further, check out this Investopedia article.

Now that we’ve discussed investment fees, index funds and ETFs, lets look at some of the current Schwab offerings. Schwab has a good selection of low-cost index funds and ETFs.

Schwab funds – Equity

For those interested in total market index funds, the Schwab Total Stock Market Index Fund (SWTSX) will likely do the job. The fees are just 0.03%. That goes toe to toe with Vanguard’s VTSAX, and has a smaller minimum investment.

If you are looking to add the well known S&P 500 index fund to your investment portfolio, consider the Schwab S&P 500 Index Fund (SWPPX). You will hold the classic S&P 500 with the very low fee of 0.02%

If you want a Schwab ETF that gets you large cap stocks, the Schwab 1000 Index Fund (SNXFX) should cover that with just a 0.05% fee. That’s a great fee to be able to invest in the largest companies.

You can also choose Mid-cap and Small-cap offers as well. Those would be the Schwab Mid-cap index fund (SWMCX) and the Schwab Small-cap index fund (SWSSX). They both have a 0.04% annual fee. These are two low cost diversified options to invest in small-cap stocks and mid-cap stocks.

Schwab ETFs – Equity

Schwab also has a number of index ETFs that get you good diversification at low cost. Below is a list of some of the equity ETFs offered by Charles Schwab.

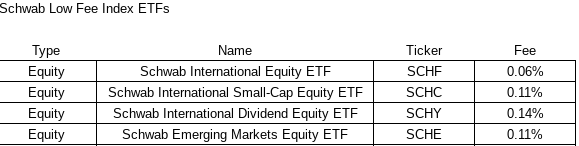

Schwab International ETFs

For those who want to hold international stocks, Schwab has a number of low cost index ETFs to give you some foreign exposure.

They offer Large, Medium and Small market capitalization equities. You have the opportunity to invest in growth or value stocks with these ETFs. In addition there is an Emerging Markets ETF that has an increased risk but also a higher potential reward.

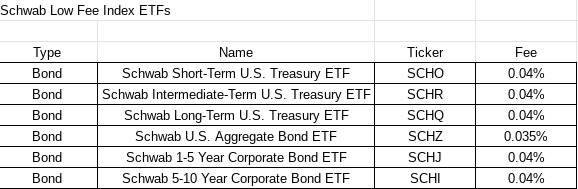

Schwab Bond Index funds and ETFs

Indexed bond funds are another way to diversify for individual investors. I’m a big fan of diversification within asset classes. In this case, we are talking bonds.

SWAGX is an aggregate bond fund that holds both US government bonds, US Agencies and Investment Corporate bonds. The average bond duration as of the writing of this article is 8 – 10 years. This is similar to Vanguard’s Total Bond Index Fund (VBTLX).

Schwab also has a number of bond ETFs all with a low 0.04% management fee. This allows you to invest in Short, Medium and long term government bonds. They also have investment grade Corporate bond ETFs with various maturities.

Real Estate

If you are looking to invest in a Real Estate Fund, consider the Schwab U.S. REIT ETF (SCHH). This fund competes with Vanguard’s VNQ REIT fund, but with a lower expense ratio of 0.07% vs 0.12%. This United States real estate fund has holdings that get you invested in storage units, commercial buildings, multi-family real estate, etc.

Target Date Funds

I’m not a big fan of target date funds due to their high fees. Most of these funds are a basic equity and bond mix, but may have some other funds as well. Take a look at the holdings and decide for yourself. If you can buy a target date fund, you can instead buy similar components. Not that difficult. You can even check their holdings once per year and adjust your stock and bond allocation to emulate that. If you are one that doesn’t want to deal with it, then a target date fund will allow you to put you investing on autopilot. Click here to see Schwab’s page with a list of target date funds.

Investment Tools and Account features

Charles Schwab brokerage accounts will allow you to easily buy ETFs and other asset classes.

Schwab advertises that if you open an account with them, you will access to over 2,000 index funds and ETFs from Schwab and other providers.Schwab index funds often have no minimums. You can also purchase fractional shares with your Schwab account. Making trades with zero transaction fees are he norm for online trades as well. Schwab has a mobile app to allow you to access your account and make trades with your smart phone.

Investment Advice

If you are comfortable making your own investment decisions, the investment process with Schwab should be easy and straightforward to execute on your goals. If not, you should consider finding a reputable fee only planner who can provide you with a written oath that confirms they are a fiduciary, acting in your best interest. If your advisor won’t provide that, then they might look out for their best interest instead! This might mean putting you into funds that give them higher commissions or higher fees.

Once the beauty of compounding begins, that higher fee will destroy your future portfolio balance. If you need the investment advice I recommend that you pay for that on a fee only basis, rather than AUM (assets under management). Paying by the hour means someone is actively working for you. Paying by AUM means that your advisor gets paid a percentage of those assets regardless of the value provided over that period. Great for them, not so great for you!

Summary – Charles Schwab: Best low cost ETFs and index funds

- Charles Schwab is one of the top low cost providers offering a variety of both index funds and ETFs. Some of the others include Vanguard & Fidelity.

- Investment Fees make a HUGE difference for long-term investors. Be careful you don’t overpay on fees.

- Schwab has a number of Equity Index funds and Equity ETFs.

- Schwab also offers bond and real estate index funds and ETFs

- Schwab offers free online trades, low fund fees and no minimums

- Investment advice – make sure they are a fee only fiduciary!

DISCLAIMER: Investing in ETF and stock index funds and related investments have a risk of loss. Past performance is no guarantee of future results. Please consult with your financial advisor to understand your investment plan before you put real money at risk. Always make sure you get the fiduciary oath in writing. The fiduciary oath means your advisor will provide advice with your best interest in mind and not theirs!