For many people, cars are the number two cost each month only behind their home or rent expense. Not only that, but vehicles are a horrible use of money. They lose value rapidly, need repairs and maintenance, require insurance, registration and fuel costs too. A vehicle is one of the top obstacles to building wealth for many people.

A famous sports saying is “you can’t stop him, you can only hope to contain him” when referring to trying to stop a superstar athlete. I feel this quote rings true for vehicles too. If you need a vehicle, you can’t stop the loss to your finances, but you can try to contain it.

Of course you could stop all vehicle costs if you had no car at all. That’s not an option for many, but if you can figure out how to live without a car you can save some serious money toward other things that give you more joy such as eating out or going on vacation, or better yet, help you save for more important goals such as your financial freedom, your kids college and more!

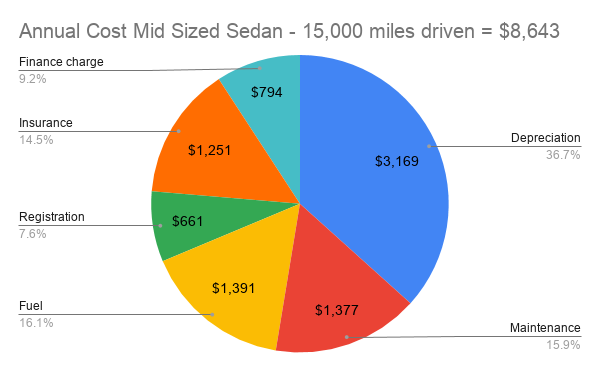

Rough numbers, in today’s dollars, it costs about 58 cents per mile to drive a medium sized car per AAA assuming a typical 15,000 miles per year driven. Their driving costs page breaks down all the components with different vehicle sizes and miles driven. Using the example of a medium sized sedan, the depreciation loss is over $3,000 per year!

These amounts vary depending on the type of vehicle and number of miles driven, but this chart should give you a reasonable breakdown of the components.

Depreciation – a silent wealth killer

As you can see, Depreciation is by far the largest cost representing slightly more than a third of the cost. That is the loss each year of the value of your car. In this example depreciation is over $3,000 per year.

You can’t stop it, but how do you contain this? Here are a few ways:

- AAA’s number is based on a new car. Instead, buy a two year old used car with less than 30,000 miles to reduce the depreciation loss, as the greatest loss in value is in the initial years of a new car. See the related article New vs Used car.

- The more expensive the vehicle, the greater the loss. Buying a reasonably priced vehicle rather than an expensive luxury one will control the depreciation loss.

- Do a little research on the brands that hold their value the longest. vehicles that retain their value better than others will suffer a lower depreciation hit over time as the residual value is higher.

- Drive the vehicle as long as you can until the maintenance and repair costs exceed the value of the vehicle. The depreciation curve flattens late in the vehicle’s life so the longer your drive the lower the depreciation expense will be per year.

Fuel & Maintenance costs

After Depreciation, Fuel and Maintenance costs are the largest categories. Combined they represent almost another third of the total costs. You can’t stop them, but how do you contain these costs? Here are a few ways:

- Check your owner’s manual. There is no need to put a higher octane fuel in your car than the manual recommends. For example, if 87 octane is recommended there is no reason so pay more for premium gas.

- Pay attention to your driving habits. Jack rabbit starts and stops waste a lot more gas and result in more wear and tear on your car over time.

- Plan out some of your shopping and errands to hit multiple stops in one trip rather than taking multiple trips. Delivery services do these “milk runs” to hit as many addresses on a delivery trip in order to save on time and fuel. You can use this technique as well for your personal driving.

- Routine preventative maintenance is one of the best things you can do to control repair costs. By getting regular oil changes, tire rotations, keeping your tires properly inflated and following the recommended maintenance for your car can save on fuel and reduce or delay significant repairs.

- Do your research up front when buying a car to make sure you are buying a make and model with a good reliability record. It’s amazing how much this can vary between brands. Consumer reports is a great source for this information. You can get a temporary one month membership online to research your car purchase or get access to the magazine for free at your local library.

- Read more with this related article: How to keep vehicle repairs under control

Insurance, Financing & taxes

Finally, the approximately last third is made up of insurance, finance charges and registration / tax fees. You can’t stop these costs, buy how do you try to contain them? Here are a few ways:

- There are a number of ways to keep your insurance premiums under control. Please see the related article Ways to Reduce Auto Insurance Premiums. Some of the ways include adjusting your deductibles, qualifying for discounts, shopping for better rates and much more!

- To reduce your finance charges be sure to go to a local credit union and small town bank to get a few quotes for financing in advance of your purchase rather than just going with what the dealer offers. Getting multiple offers is the best way to ensure you are getting the best interest rate to keep finance charges in check.

- Buy less of a car now and take the payment savings and save that toward your next vehicle. The biggest way to reduce finance charges is to reduce the loan to begin with! By saving for your next car years before the purchase you are shifting the game in your favor rather than the finance company. If you need more than a 48 month loan to afford the car you are probably buying too much car!

By reducing your automobile expenses you can free up money for other areas of your life, including saving for your retirement and your kids college. If you buy a reasonably priced car and keep it in good condition you will be stretching your dollar which will help you improve your net worth and get you on track to a better financial future.

Give us your feedback. Do you have other ideas not mentioned here? If so we’d love to hear from you.