You hear a lot of discussion these days about emergency funds, and with good reason. The recent pandemic really hit people hard and not having adequate savings can create a catastrophic financial situation. For example, many people filed for unemployment benefits but due to the massive backlog of claims it was weeks or even months before some received any relief.

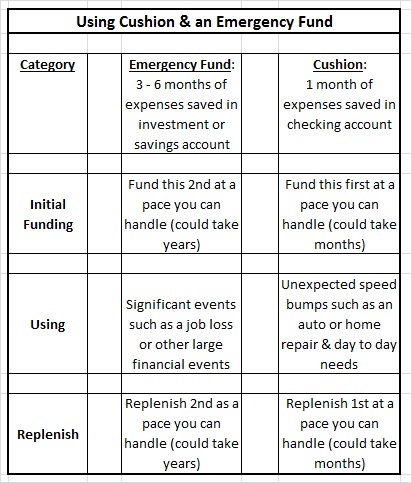

There is also another concept I would like to introduce you to that I call cushion. Both an emergency fund and cushion, if used in tandem, can give you the financial security and peace to make your life a lot less stressful.

Let’s explore these concepts:

“Cushion”

Cushion or “attitude money” would be money that would cover a speed bump in your budget. It wouldn’t be significant enough event to be considered an emergency, but enough to throw your normal spending off. Let’s say it’s equal to about one month of spending. If you spend $5,000 a month, for example, your first $5,000 would be your cushion.

Cushion provide some space in your checking account so that you don’t need to stress out over every bill, wondering if you are going to overdraw. You have one month of cushion in your checking account so you know you are good.

Also, if there is a surprise such as an auto repair (say $1,500) or an insurance claim and you need to pay a deductible (say $1,000) you have the money to cover it. These are speed bumps in your monthly spending. The cushion money would cover you for those.

I also call it attitude money because it allows you to have a “positive attitude” about your monthly finances since you don’t have to worry or stress out over your monthly bills or a speed bump or two, which are part of life and will happen to everyone.

Emergency Fund

An Emergency fund, in my opinion, is to cover a significant event such as a job loss or a major medical expense situation. This would be months (say 3 to 6 months or more) of typical expenses in savings.

A lost job is not a speed bump. This is a major event. Having, say 6 months, of expenses saved up would be a huge benefit to have in case of a job loss. If you are a two income family and one person loses their job but the other is still employed, then 6 months of an emergency fund could actually last up to a year.

Also a major medical claim that consumed your deductible and resulted in co pays that may have taken you to your maximum out of pocket would be another reason to tap into the emergency fund.

How do I get there?

Here are steps if you want to get started:

Estimate your monthly spending. Add up your expenses by looking at your bank account and credit card statements. One month’s worth would be your cushion number.

Once you have the cushion number determine how much you can save to get there. For example, you might decide that you are going to put away $200 per month until you build up to one month worth of expenses. In our example of $5,000, it would take 25 months or about two years to get there. If you are more aggressive you could get there much faster.

The cushion money would stay in your checking account. You would have an average balance of about $5,000 all the time so that you didn’t have to worry about over-drafting or not having the money to handle a speed bump.

Once your checking account is handled (one month’s worth of expenses) you move on to your emergency fund. With this one you could continue the same $200 per month, for example, and keep putting that money in a separate savings or investment account until you got to your three months number (or more).

What happens when you have a speed bump or emergency?

The money is there when you need it, so use it. For example, let’s say you have an unexpected $1,000 car repair. You use the money in your checking account to cover the charge and are now down to a $4,000 average balance.

You then start adding the $200 a month to that account again until you get back to the $5,000 target. In this case it would take you 5 months to get that balance back to $5,000. What was nice is that the “cushion” was there when you needed it and you didn’t need to run a credit card balance or stress out over having the unexpected charge.

The same goes with the emergency fund. If you need to tap into it for an emergency you should go back to funding it again when you are able. It may take months or years but that is okay. You are building financial safety nets to make your life less stressful when the time comes!

In summary:

- Cushion or “attitude money” is an extra month of expenses saved in your checking account to give you a positive attitude knowing your monthly bills are covered, including the inevitable speed bumps.

- An Emergency fund is multiple months of expenses saved in a separate savings or investment account. This money is there to cover a catastrophic event such as a job loss or other significant financial event

- Both cushion money and emergency funds should be replenished over time after they have been used.

- The goal of both is to dramatically reduce your stress about money and put you in a better position financially!