Win – Win for you

Get an improved water heater can be a win for you in two ways. First, you save on future energy costs by getting a more efficient unit that uses less energy. Second, there are tax credits and incentives that get you money back to improve the return on your investment!

Energy savings

Homeowners migrating from the old standard model tank-type water heater to the new tankless high-efficiency water heater should see immediate energy savings. It makes sense that the old style, which runs 24 hours a day, would use much more energy than the tankless version, which only uses energy at the time you need hot water.

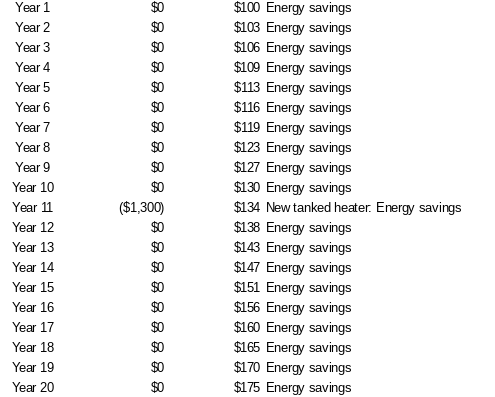

It’s estimated that a tanked water heater accounts for approximately 10% of your total home energy costs. The savings of replacing a gas tanked water heater with a gas tankless water heater is approximately $100 per year in annual energy usage (tankless is 20-30% more efficient than tanked). In addition, tankless water heaters have an estimated life of 20 years versus 10 years for a tanked water heater.

An energy star-certified unit is a good indication that the unit you are considering buying will offer good energy savings. However, be sure to ask questions and read on to ensure your new unit will qualify for the credit.

Tankless Water Heater Tax Credit

A hot water heater using natural gas generally qualifies for the federal government tax credit. The tax credit is processed by the U.S. Internal Revenue Service (“IRS”). You will need to submit the appropriate tax form (Form 5695) with your income tax return in order to claim the credit.

The applicable portion of form 5695 that applies to water heaters is Part 2, “Non-business energy property tax credits.” The only exception appears to be solar water heating systems, which are included in Part 1 of the form.

Some of the general requirements of the nonbusiness energy property tax credit are that it must be for your principal residence located in the United States. On the tax form you are required to enter the full physical address of the property (including the zip code) where the water heater was installed.

The nonbusiness energy credit does state that it only applies to “qualifying improvements that were not related to the construction of the home.” I believe the reason for this is that the tax code wants to provide an incentive for existing home owners to replace old inefficient units with more energy efficient units. Those involved in a new construction will already be putting more modern units in anyway, so they don’t need an incentive to do so.

There are some exceptions that allow you to apply the credit to a second or vacation home. However, it appears that the only water heater that applies for these homes are “solar water heaters.”

When you read the tax form 5695 instructions, the applicable portion for water heaters is worded as “qualified natural gas, propane, or oil hot water boilers.” Notice that electric water heaters are not mentioned.

Qualifying units

So, it appears the following water heaters may qualify for the credit if they meet the energy efficiency, principal residence and geographic location requirements:

- Natural gas water heaters

- Propane water heaters

- Oil water heaters

The other question is, what does qualified energy property mean? Further in the instructions you will find that qualified energy property appears to be “a natural gas, propane, or oil water heater that has a Uniform Energy Factor of at least 0.82 or a thermal efficiency of at least 90%.” What this means is that your annual fuel utilization efficiency must be high enough to allow for a credit.

You are also required to obtain the manufacturer’s certification statement. This will be your validation that your unit qualifies for the tax credit. You are not required to send in the certification in with your federal income tax return, but instead you need to keep in on file to support the credit you have claimed.

IRS instructions and forms

The IRS instructions can be found with this link. A copy of the IRS form 5695 can be found with this link as well.

The maximum amount you can claim as a credit for a water heater under the nonbusiness energy property credit in the tax code is $150. There is also a lifetime limitation of $500 in energy credits that you can claim for making energy-efficient improvements. There is a Lifetime Limitation Worksheet as part of Form 5965 that will determine if your lifetime limitation has been met.

Also note that the energy tax credit is a non-refundable tax credit. What that means is that the tax credit cannot reduce you tax liability below zero. Some credits offered in the Internal Revenue Code are refundable credits. What that means is that you can actually reduce your tax liability below zero. When that occurs, not only do you pay zero tax, but the government actually pays you.

It appears that the energy credit will be extended at least for the next year of so (beyond 2021). Be sure to check the IRS website to confirm if the credit is still being offered at the time you are purchasing your unit.

Tankless Water Heater Brands

Rinnai America corporation at this time is often known as the manufacturer of the number-one brand of natural gas powered tankless water heaters. There are many other good providers of gas tankless water heaters as well.

Some of the most common brands of tankless water heaters and website links include:

- Rinnai tankless water heater

- Rheem tankless water heater

- Ruud tankless water heater

- Bosch tankless water heater

- Noritz tankless water heater

There are many other brands offering high-efficiency water heaters. Regardless of the brand of tankless gas water heaters, be sure to vet out the manufacturer and confirm that their unit meets the energy efficiency standards to qualify for the tax credit. Also confirm that your installer will be able to provide you with the manufacturer certification statement.

Return on Investment

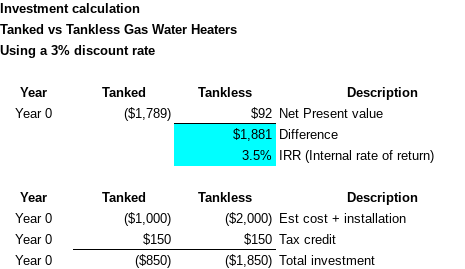

I decided to run the numbers to compare an average tanked vs tankless hot water heater. In my assumption I used a 3% discount rate over a 20 year period.

Tankless units cost more, but also last twice as long. The average tanked water heater lasts approximately 10 years compared to a tankless unit that should last 20 years.

I also assumed that both a tanked and tankless will qualify for the $150 tax credit. I didn’t include maintenance costs as both units should be drained or cleaned yearly, which can often be done by the homeowner.

What I found is that the tankless unit pays for itself over the 20 year life. The tanked unit does not. The net difference was about $1,900 over 20 years in favor of the tankless unit.

This is because you have to buy two tanked units for every tankless unit due to the difference in useful life. In addition, the tankless unit saves you on energy costs each year and a tanked does not.

Even if you did have to pay for some cleaning or maintenance of the tankless unit every year or so, you likely still come out ahead due to the net savings shown below.

The other big benefit, is of course, having continuous hot water whenever you need it!

Summary: Energy tax credit for natural gas Tankless Water Heaters

- Tankless gas water heaters are a win-win; You save energy & qualify for tax credits

- Tankless gas water heaters will save you approximately $100 per year in energy usage

- The IRS offers a $150 tax credit for installing an energy efficient gas water heater to replace an old unit at your primary U.S. residence

- There are numerous gas tankless water heaters in the market today. Rinnai is probably the most well known brand at this time.

- A tankless gas water heater pays for itself in energy savings over a 20 year period. A tanked unit can’t say that!