Sounds crazy at first when you read this, but I’ll explain.

Sometimes we can’t see the forest for the trees

As investors we are wired to optimize our investment performance. We also hate losing money. In my opinion this leads us DIY investors and most financial advisors down a path to look at each investment separately, and if it is not performing, we want to get rid of it or reduce the exposure.

Case in point, long term US Treasury bonds. These have performed quite poorly early in 2021 and again in 2022. Equities on the other hand did pretty well in 2021, but not so good in 2022. Back in 2021 it seemed like a no brainer to just dump the bonds and load up on stocks, especially with the poor prognosis for bonds by many due to their low yields and likely higher interest rates on the horizon, right?

This is a trap. This “individual investment only” thinking leads us to chase returns. It puts us in the mindset where we try to figure out and predict where the market is going next. This is a losing game.

Are interest rates going up? Are they going down? What is the Fed doing with rates? What is the government doing with stimulus packages and taxes? What industries are going to do well and which ones poorly? Is the economy going to be booming soon or are we looking at another round of layoffs?

And the list of questions goes on and on and on…it never ends…

At some point you get turned around. Almost frozen because you don’t know if the market is topped out, going up or down next. The reality is, you can’t know. No one knows. It’s like trying to predict what the weather is going to be like a month from now. There are too many variables that factor into it which includes unknown events that have not even happened yet.

There is a better way

I was initially introduced to the “package style” of investing with the book the “Permanent Portfolio” by Craig Rowland, which is based off of the concept introduced by Harry Browne in the 1970’s. The logic was to create a portfolio that does well in all economies (inflation, deflation, prosperity, recession).

The permanent portfolio is a little too conservative for my taste, but it promotes the concept of the package of uncorrelated investments at the right proportions, loud and clear.

In order to reduce the volatility, and increase the Safe Withdrawal Rate (SWR), you need a balanced portfolio with assets that are not all correlated the same. The package of investments and the delicate ratio of each is the key. Each has their role in the portfolio.

In other words, if all the investments go up together, and all go down together, are you really diversified? Not really. If you are in ETFs and index funds you are at least diversified from an individual company perspective, but not from an overall market perspective.

If the stock market drops 40% tomorrow and all your investments are correlated to equities, you are going to take serious losses. Now if you are in your accumulation phase and you don’t mind the wild ride, then hang on and ride it out.

However, if you are approaching or in the withdrawal phase, you have entered an entirely different ball game. Time is not on your side. Sequence of return risk and a significant drop like 40% could put you on a path to running out of funds at some point.

The Sum is Greater than the Parts

Don’t take my word for it. Look at the numbers and hear from others.

There are some really good websites out there that I encourage you to use. This type of information was not available to DIY investors years ago, but they are now. These sites allows investors to check on their own plan or use it as another data point to keep their financial advisor in check.

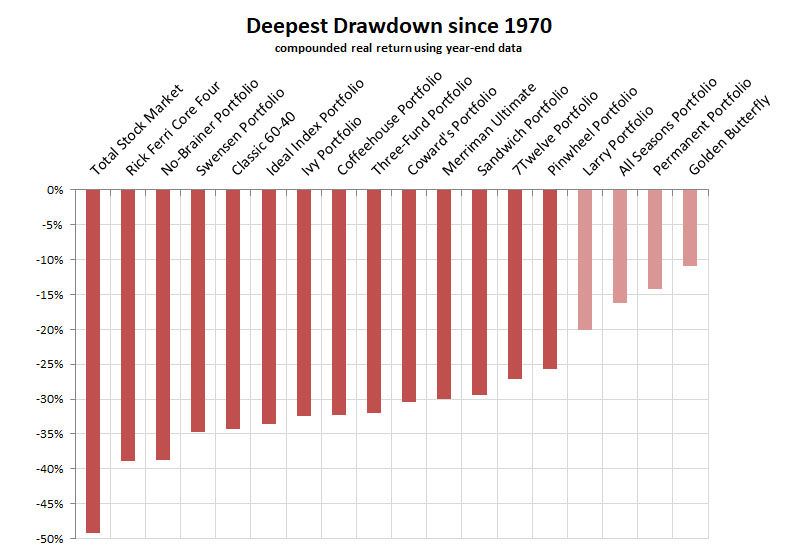

Portfoliocharts.com gives you a tool that allows you to determine the SWR and volatility of your current and desired portfolios. This will show you how well your current portfolio performs using the last 50 years of data. Portfolios such as the “Golden Butterfly” and the “All Seasons” are examples of ones that use this risk parity style of investing where it’s the package of uncorrelated investments that drives the overall result.

Portfoliovisualizer.com allows you to confirm if your specific investments are correlated or not. To have a good package you don’t want all investments to be equally correlated. When some go up you want others to be flat (zero correlation) or go down (negative correlation) or vice versa.

RiskPartityRadio.com is a very good website and podcast that does a great job diving into the risk parity style of investing. It tells you to stop trying to predict where things are going and instead build a portfolio that will allow you to be prepared for any market situation. It does this by guiding you to put together a portfolio with the right proportions and asset correlations.

Equities will likely still be the engine that drives investment results. If you sandwich equities with hedges such as gold and US treasuries you can reduce volatility when times get tough.

These hedges might go down or stay flat when your equities are doing really well, but when your equities take a major dive they will be around to soften the blow. By reducing volatility you increase the safe withdrawal rate. I have another article that explains this in more detail.

Like the old saying, it’s not the heat but the “humidity” that gets you. In the case of investing it’s not the performance but the “volatility” that gets you!

Using the 40% one day market drop example, what if your portfolio only dropped 15% instead of 40% like the overall market did? That would be much more palatable, wouldn’t it?

Conclusion

This is why I’m unhappy when all my investments go up at once. That means my investments might be too correlated, and therefore not properly diversified.

When my overall portfolio goes up nicely in value when some individual investments are up and others are down, I know that I’ve got more of the right balance. This give me more confidence in knowing that the next crazy market event won’t be devastating to my investment plans.