As an individual in a consumption based society, it’s an almost unfair battle for your wallet. From a very early age you have been, and continue to be, pummeled with advertising from all kinds of mediums that hit all of your senses. Examples include TV commercials and social media ads (sight and sound), food odors from restaurants pumped in the outside air (smell), ice cream samples (taste) and sample products at your favorite store (feel).

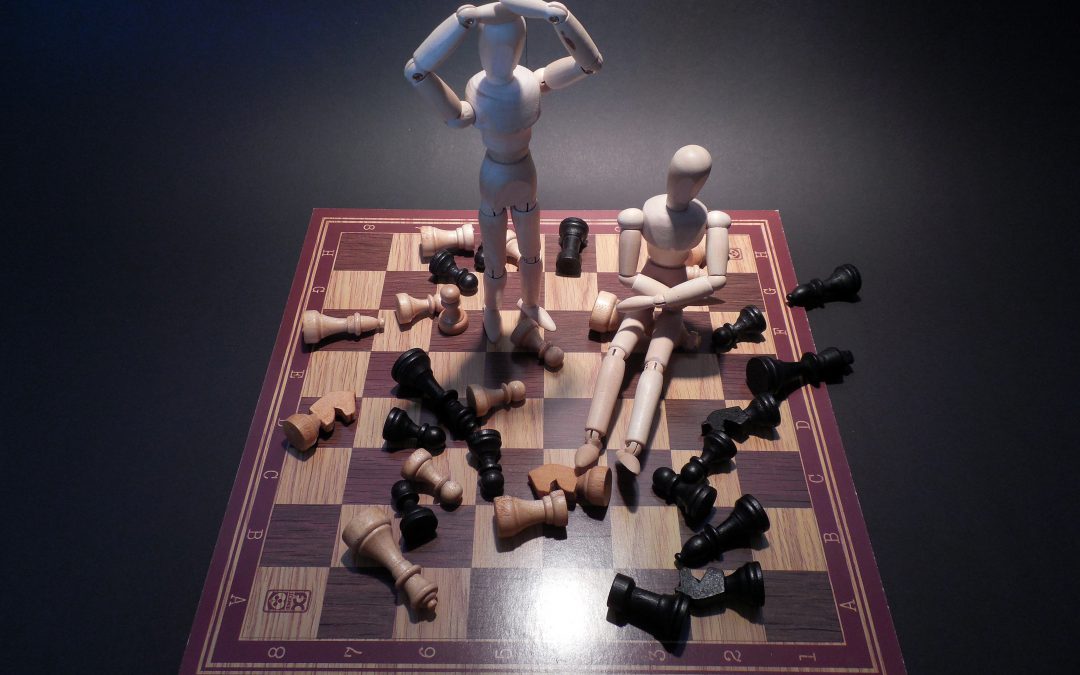

No people or organizations are solely at fault. We all want the same thing. We first want to survive and then to flourish. A company’s owners and employees want that, and you want that for yourself and your family. The difference is that companies often have hundreds or even thousands of employees whose primary goal is to get and keep you as a customer. You are outgunned and outnumbered. It’s almost unfair.

What’s interesting is that we all have multiple roles. We might be working for one of those companies in our employee role, and then we are the consumer in our own individual role. Most of us don’t even recognize how outnumbered we are as a consumer, as it is just seen as normal life.

Companies have perfected their ability to get you to buy their products. You might not even notice. In fact, if enough years go by, some things become ingrained as part of our culture and we don’t even think about it. For example, eating cereal for breakfast, getting an auto loan, or giving greeting cards for birthdays are all the result of decades of marketing efforts that worked their way into everyday society. And, as new companies try to sell new products (such as almond milk or veggie burgers) you see a major battle going on by the incumbent companies to keep those new products out, such as lobbying to pass laws to not use the word “milk” or “burger” on the product label unless it came from an animal. Again, this is all part of the normal competitive balance of first wanting to survive and then to flourish.

As companies continue to want to survive and then to flourish, they find additional ways to accelerate sales. In the old days our elders paid with cash when they bought items. Because of that, they would save and save until they had enough money to buy a large ticket item such as a car. Companies figured out that one way to increase sales was to get customers to buy things now even though the customers didn’t have the money. This is called credit. This increased sales by pushing consumers to buy sooner than when they would have otherwise been able to. It also created a new business called financing where businesses could make money (sometimes more than the product profits themselves) by charging interest on the loans.

Most companies are not trying to do anything nefarious, they are just trying to survive and flourish. They will, however, take advantage if you let them. That is why so many people can’t get ahead financially. They are outgunned and outnumbered by marketing campaigns, salespeople, credit cards, lottery tickets, and all kinds of opportunities to be parted with their money. Organizations need to do it to survive and flourish. If you let them, they will take advantage.

You can offset these disadvantages by first becoming aware. Be aware that there is a battle going on daily for your money. If you are not aware, years may go by until you finally realize that you have spent money on all kinds of unnecessary things because it was so easy due to one click ordering, free shipping, easy returns, etc. You’ll want to retire because you are old and tired but you won’t be able to because you overspent on all kinds of products or services that really didn’t give you any value. In fact, you can’t even remember where most of your hard-earned money went. It just seemed to disappear into thin air.

Second, don’t drift through life financially. If you do your wallet will be eaten up. Instead, you need to have a plan with limits and spend intentionally so you don’t fall prey to these marketing efforts.

One way to do this is to make a list of what you plan to purchase before you enter a store. Stick to the list and don’t buy other things that you decide at the moment that you must have (unless you legitimately forgot to put something on the list). For any new items not on the list, adopt the handgun cooling off rule, which requires you to write down that item and then wait 72 hours before you buy it. In many cases, after you wait the 72 hours you will often decide that you don’t really need the item after all. The point of this exercise is to reduce impulse buys, which are often the result of exceptional marketing getting a good grip on you at that moment.

The reason it is “almost unfair” but not “completely unfair” is that with awareness and tools you are able to offset the one-sided game with you on one side and thousands of people and companies on the other. In fact, being smaller, you have many advantages. You are like a speed boat and the companies are like large ships. You can make quick changes while companies move much more slowly. Once you realize it’s a game you can play to win too, and take advantage of your nimbleness. You can earn credit rewards and get free trips, play the discount offers, buy items off season at big discounts, etc. You can “pay yourself first” each month by putting some money away to invest for your future before you are tempted to spend it on stuff.

By being intentional about your spending and understanding that there is a battle going on for your money, you will be more in tune with marketing gimmicks and offers. This will give you the knowledge and power to say no or walk away from making a purchase you will regret later. By saving up for the items you want to buy before you buy them, you will be eliminating impulse buys, debt and interest that cripple so many consumers. You will need some patience and diligence, but you will ultimately turn the tables and get control of your financial future!