In the United States we all have to file a tax return as individuals to report our income taxes. Forms 1099 and 1040 are extremely common, so having a good general handle on what they do and how they work will make tax season much less intimidating and confusing.

Tax Form 1099 – what is the purpose

This form goes back to the early 1900’s, so it has been used for quite a long time. There are over 20 different types of 1099 forms. If you want to see a list of all of them you can check out this Wikipedia page.

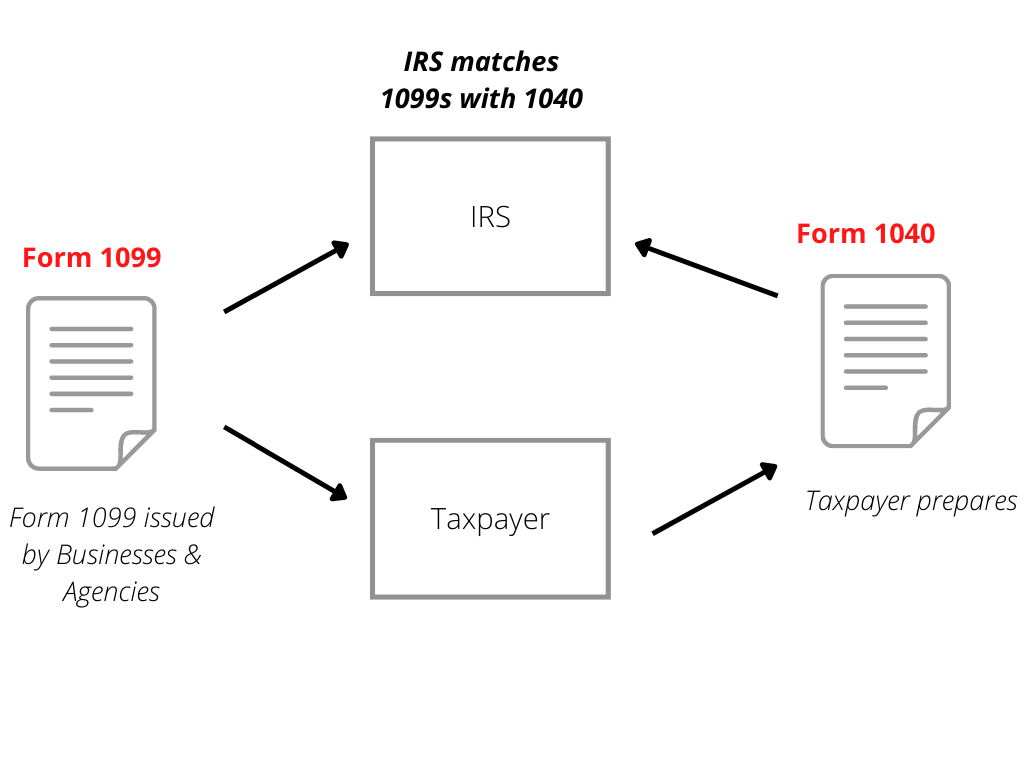

What’s more important is to understand what a 1099 is used for. It is used for business and government agencies to report various types of amounts (typically income) paid to taxpayers. It is also reported to the Internal Revenue Service (“IRS”). This is to officially provide that information to the taxpayer (who should generally already know it) but more importantly, to the IRS.

Depending on the 1099 form, there are minimum thresholds for reporting. Form 1099-NEC and Form 1099-MISC are used to report non-employee compensation and other miscellaneous income payments. The minimum is $600 per calendar tax year to require reporting.

For example, if a company paid you a total of $450 for the calendar year for non-employee compensation, they are not required to send you or the IRS a 1099-NEC since it is below the $600 reporting threshold. It is still taxable income and it still needs to be reported by the taxpayer, but a 1099 form is not required to be issued in that example.

Other common 1099’s include 1099-INT (interest income) and 1099-DIV (dividend income). Both of these are typically reported to you by banks, financial institutions and investment firms. The minimum threshold to report is $10 a calendar year. So, you will receive a 1099 in this case if you receive that amount or more. Again, you still need to report the income on your tax return, you just might not get a 1099.

It is reported to the IRS to make sure that a taxpayer reports gross income on a tax return. This third party reporting is a way of keeping everyone honest.

With electronic reporting now the norm, the IRS can easily match the 1099’s reported with the taxpayer’s return. Notices are then sent to taxpayers for any differences in the matching process. Of course one of the key matching criteria is the social security number, which is how the IRS can electronically match all the data.

The payer is required to report it on the 1099 and the payee is required to report it on a tax return, typically form 1040 for individuals.

IRS Form 1040 – Federal return you file with the IRS

Form 1040 is the main federal income tax return for individuals. It is the form where you report your taxable income as well as deductions and credits. The end result will be your official filing with the IRS. You are required to sign off on this form each calendar year with the filing of the tax return.

The 1099’s you receive from companies are inputs you need to complete your tax return. Most taxpayers and tax professionals use software to complete your tax return. Part of the process is to take these 1099’s and key them into the software so that the amounts are included on the return. Ultimately the 1099’s are the supporting documents used for many of your gross income.

Many of the tax software providers (such as Turbotax) allow you to automatically import your 1099’s directly to your tax return, saving you the manual input time and improving accuracy. You’ll need to validate key information from the 1099 issuers in order to unlock the documents to perform the imports.

Common 1099 Forms

Now that you have a understanding of how 1099’s are used on tax returns, let’s cover some of the most common 1099’s in more detail.

Form 1099-DIV

If you own investments that pay dividends in a taxable brokerage account, you will likely get statement 1099-DIV issued to you for the calendar year to report this investment income. This statement will disclose how much you received in dividends during the year.

It will also breakdown how much of the dividends received were qualified and unqualified dividends. Both of these amounts will be needed to complete your tax return.

Form 1099-G

If you received government tax payments during the year, you will likely receive a form 1099-G. This could be for receiving a state of local tax refund. It also could be for receiving unemployment compensation during the tax year. Keep in mind that most unemployment benefits are taxable income.

Form 1099-INT

If you have a bank account or Certificate of Deposit at a financial institution, you will likely receive a 1099-INT. This is to report the interest income you received during the tax year. This is taxable income and is required to report on your tax return.

Form 1099-MISC

1099-MISC forms are used to report miscellaneous payments such as rent, prize winnings, or legal settlements.

Form 1099-NEC

The 1099-NEC is used to report payments for non-employee compensation. If you are an independent contractor and you perform services for a company, they will likely issue you a 1099-NEC for the payments you received during the tax year.

As an independent contractor, you would need to report this business income on your tax return, typically on Schedule C of form 1040. As a small business owner you are also responsible for self-employment taxes. This would be the Social Security and Medicare taxes on your income.

As a W-2 employee, you pay 7.65% (6.2% social security + 1.45% medicare) as payroll taxes on your paycheck. Your employer is then required to match this, putting in an additional 7.65% for a total of 15.3% (1/2 from you and 1/2 from your employer).

As an independent small business owner, you are responsible for the full 15.3% self employment tax. This is typically filled out on the Schedule SE of Form 1040.

You don’t use 1099-NEC to report income for employees. Employee income and payroll taxes are reported on form W-2.

Form 1099-R

If you have a retirement plan, you would receive a 1099-R for any distributions or rollovers. You need to read the codes carefully to ensure you are picking up the numbers correctly on your tax return.

Form SSA-1099

If you receive social security benefits you will receive an SSA-1099 form. This form reports both your social security income as well as the amount deducted for your medicare coverage.

These amounts will get input on your 1040 form as part of your calculation of gross income.

Getting an IRS matching notice

If you get an IRS notice that you have a matching issue with your 1099’s not being complete, don’t panic. Instead, do your research to confirm that the error is legit. You may find that the IRS made an error, or your may find that you made an error.

Regardless, you want to respond to the notice professionally with the information being requested or resolution recommended. The sooner you clear up the issue, the better.

Tax Return Filing dates

1099’s are generally required to be sent to taxpayers by January 31st following the calendar year being reported. This is to allow the individual taxpayer to complete and file their tax return by April 15th. Note that an individual taxpayer can file an extension to defer the filing of their return to August 15th.

Remember that even though you can delay the filing of your personal tax return by filing an automatic extension, that does not change the due date to pay. Your taxes have to be paid by April 15th in order to avoid interest and possibly underpayment penalties, depending on how short the amount ends up being when you file your return.

State Income Taxes

Every state with an income tax has a different form. Generally speaking, the state return starts with the Federal return and then adjustments are made to arrive at state taxable income.

The 1099’s you used for your federal return carry over to your state return, with the exception of additional state income tax adjustments that might apply. Most states will have adjustments adding or subtracting from federal taxable income to arrive at state taxable income.

Summary – IRS forms 1099 and 1040: What are the differences?

- 1099’s are used to report income to taxpayers and the IRS.

- The IRS will perform electronic matching of 1099’s to your tax return to ensure all income is reported

- Employees receive a W-2, independent contractors receive 1099-NECs

- There are numerous other common 1099’s for dividend income, interest income, social security income, etc.

- Form 1040 is the end product of the 1099’s and W-2’s received.

- The IRS will let you know if there is a 1099 matching issue with your return

- Individuals tax returns are due by April 15th of the following year, or August 15th if extended

- State returns are impacted by your 1099s as well