Trusts need a tax identification number, but that could be an already existing social security number or an employer identification number (EIN), depending on the type of trust.

Remember that a social security number and an EIN are both nine digits long. The social security number is what individuals use for their tax returns and an irrevocable Trust, like most other business entities, uses an EIN.

However, a Revocable Living Trust is a grantor type trust that has an optional variation to this.

Revocable Living Trusts

These trust are fairly common. They allow people to avoid probate for their heirs by setting up a trust while living.

They are revocable because they can be reversed if the grantor later decides later they don’t want a trust.

These types of trusts become irrevocable when the grantor pass away. It remains revocable until then. It is a separate legal entity in both cases.

While living, a common practice is to use the grantor’s social security number as had been done previously before the revocable living trust was created. Essentially, the grantor is just re-titling the assets for legal reasons to put it in a trust while still retaining the same tax identification number as before.

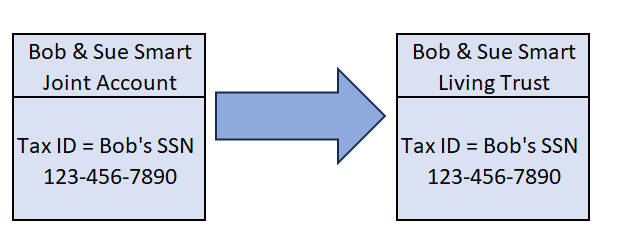

Revocable Living Trust tax ID example

Let’s say that a married couple, Bob and Sue Smart, meet with an Estate attorney at a local law firm and decide it is a good idea to put their assets in a revocable living trust, called the “Bob & Sue Smart Living Trust dated November 14, 2023.”

One of the assets Bob and Sue have is their standard taxable brokerage account at Vanguard Investments. Currently the brokerage account is titled as a joint account with Bob and Sue as the owners. The tax id number attached to that account is Bob’s social security number. When the couple receives their 1099-DIV and 1099-B tax statements for that account they have Bob’s social security number on them. They include that information in their joint tax return for the applicable tax year.

Use your Own Social Security Number as Before

With the help of their estate planning attorney, they set up a Living Trust. Part of that process involves moving all applicable assets into the trust. This includes sending Trust paperwork to Vanguard to request that a new brokerage account be set up in the name of the trust called the Bob & Sue Smart Living Trust. The tax id number that is provided to Vanguard for the new account is still Bob’s social security number, just like the joint account.

Once the new brokerage account is set up, the assets of the joint brokerage account are moved to the Bob & Sue Smart Living Trust brokerage account automatically by Vanguard’s back office process. There are no tax implications for this. The assets are just placed in an account with a new legal name.

At year end, the 1099-DIV and 1099-B statements issued by Vanguard from the new trust brokerage account will contain the same tax id number as they had with the Joint Account. The only difference is that the name on the tax form would say “Bob and Sue Living Trust” rather than “Bob and Sue Joint Account.”

This is a completely acceptable method in the Internal Revenue Code and easier to implement. You can read more about this on the IRS website on Trusts. Note that this is Optional Method 1 for a Grantor Trust per the IRS.

There is no difference on the treatment for the joint tax return at the end of the year. The tax ID number reported from Vanguard is the same as it was before the change.

Graphic of Example

This same re-titling of assets would occur for all other assets the grantor wants to place in the trust. This could include a bank account at a financial institution, other taxable investment accounts, real estate, etc. Note that a retirement account, such as a 401(K) or IRA, cannot be titled as a trust, since the tax rules require that these assets be held by an individual. You should seek professional guidance from an estate attorney or tax advisor to understand the options surrounding retirement accounts and an estate plan.

Note that you can get an EIN for a Revocable Living Trust if you want to, but that would require the additional administrative burden of either filing Form 1041 for Estates and Trusts, or following one of the other optional methods. You can read more about this at the IRS link provided here. Trusts can get very complex, so you should discuss options with an estate planning attorney or tax advisor before making any decisions.

Irrevocable Trust EIN

An Irrevocable Trust is treated as a separate taxable entity for tax purposes, and as a result, requires an Employer Identification number (EIN). You cannot use a social security number for an Irrevocable Trust as you can for a Revocable Living Trust using an Optional method.

As mentioned above, you can continue to use your social security number for your Revocable Living Trust. However, once you pass away the Revocable Trust immediately becomes Irrevocable. Once the Trust becomes Irrevocable, the trustee will need to get an EIN issued by the IRS, most often via the IRS’s online application process.

Irrevocable Trusts are required to file an annual tax return using Form 1041, U.S. Income Tax Return for Estates and Trusts. The EIN issued to the trust will be used on the return. The trust will pay taxes and issue K-1’s to beneficiaries if applicable. You can read more about the filing requirements on the IRS’s website on Trusts.

Executive Summary: Do Trusts Need Separate Tax ID number?

- All Trusts need a Taxpayer Identification number

- A Revocable Living Trust can often continue to use the Social Security number of the grantor

- This means that for income tax purposes, the income of the Trust is recorded on an individual’s own tax return

- An Irrevocable Trust will need a unique number for entity tax reporting, also known as a Employee Identification number (EIN)

- The example of Bob & Sue above show how an asset, such as a brokerage account, can retain the previous Tax ID number when changing legal ownership reflecting the name of the revocable living trust

- There are many different types of Trusts, and they can get quite complex, so using an estate attorney and tax advisor is recommended to understand your tax filing options

Hi,

So in the above example, what happens if Bob passes away first? The Vanguard brokerage account is associated with Bob’s SSN, but the ‘Bob and Sue Living Trust’ is now solely under Sue’s SSN?

Correct, typically you just contact the investment firm (in this case, Vanguard) and get the social security number changed to the wife.

Hi, thanks for this as we are just getting started with our revocable trust. In your example, what if Sue has a brokerage account individually in her name/taxid? What are the implications of moving it into the trust account that has Bob’s SSN indicated? thanks

Hi Bill, you would contact the investment provider and they can walk you through the steps. They might direct you to change Sue’s account to a joint account first. Typically, after providing the revocable trust paperwork, the firm will close the brokerage account, open another that is titled as the revocable living trust, and then transfer the assets to the new account in kind.

So, upon death of the last member of a joint revocable trust, the trust becomes irrevocable and requires an EIN. I assume you would file an income tax return using the EIN, but how is that referenced back to the individual members SSN that died. Won’t the IRS be looking for an individual tax return for their SSN?

A final individual 1040 tax return is filed for the deceased that goes from January 1st to the date of death using their SSN. This is where the individual filing ends. Here is a link to an IRS site that provides more information. https://www.irs.gov/individuals/file-the-final-income-tax-returns-of-a-deceased-person. The trust then picks up the activity after the date of death using a new EIN for the trust. The trust then files form 1041. Getting things right for both the final individual return and Trust return(s) can get tricky. I recommend you find a local tax CPA or enrolled agent who can help you navigate this correctly.